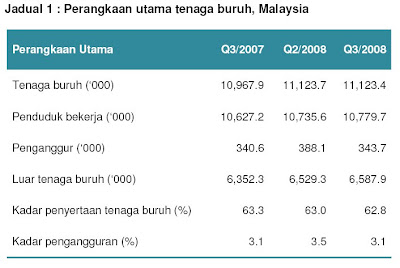

Source: Dept of Statistics

1)As at Q3 2008, Malaysia has 11.1 million workers of which 10.8 million are working.

2)Out of the 10.8 million workers. 6.6% fall in the 55-64 age group. That 6.6% is considered 'old' by some parties.

3)Out of the 10.8 million, only about 10% are paying income tax. The remaining balance of the workforce has salaries below the tax band of RM2,500 per annum.

4)Total Government revenue in 2007 was RM140 billion. 50% (RM70 billion) of that revenue came from direct taxes. Out of that RM70 billion, RM20.5 billion (17%) comprise of individuals' income tax. The rest are companies' income tax (46%), petroleum income tax (29%) and miscellaneous types of taxes (8%).

5)About slightly over 1 million workers contribute to RM20.5 billion income tax.

It is not only a question of the aging workforce as reported by The Women, Family and Community Development Ministry here. My former employer, now aged 60, earns up to RM2 million a year, excluding bonuses. Try beating that. Salary, we assume, is proportionate to skill set and demand for that skill set. The question is not of age alone, nor salary, nor skill set. Barking up the wrong tree.

The Women, Family and Community Development Ministry should drill down as to why the rest of the nearly 10 million are not contributing tax. Well, we all it's the tax band for sure, but what are their training needs? Are these 10 million people doing alright or not? Analyze that data properly and see if they tell a story. From there identify what's really wrong.

No comments:

Post a Comment